- Tech Funding Daily

- Posts

- tech vnture #3

tech vnture #3

Networking tech, Cybersecurity, Nile funding round, and semiconductors.

Welcome to our #3 weekly newsletter on funding in the technology sector.

This newsletter is designed for the busy investors in the tech startup scene, including venture capitalists, private equity professionals, and hedge funds, as well as investment bankers and startup founders. Plus, everyone else that wants to keep abreast of what is happening in the buoyant tech funding scene.

We do not want to provide just a newsletter on funding, but also granular data that our subscribers can use in their line of work. This includes a comprehensive list with company names, investors, type of funding, sector, and business descriptions, among many others. Please contact us for more information.

Kind regards,

TF Analytics team.

Round update: Networking, Cybersecurity

For the past week, we counted 61 funding rounds in the tech sector for a total amount raised of about $1.2 billion. This is down from the prior week by about 20 rounds and a little more than $100 million. Activity may continue to slow down as we move into a laid-back August. Expect a pickup in September.

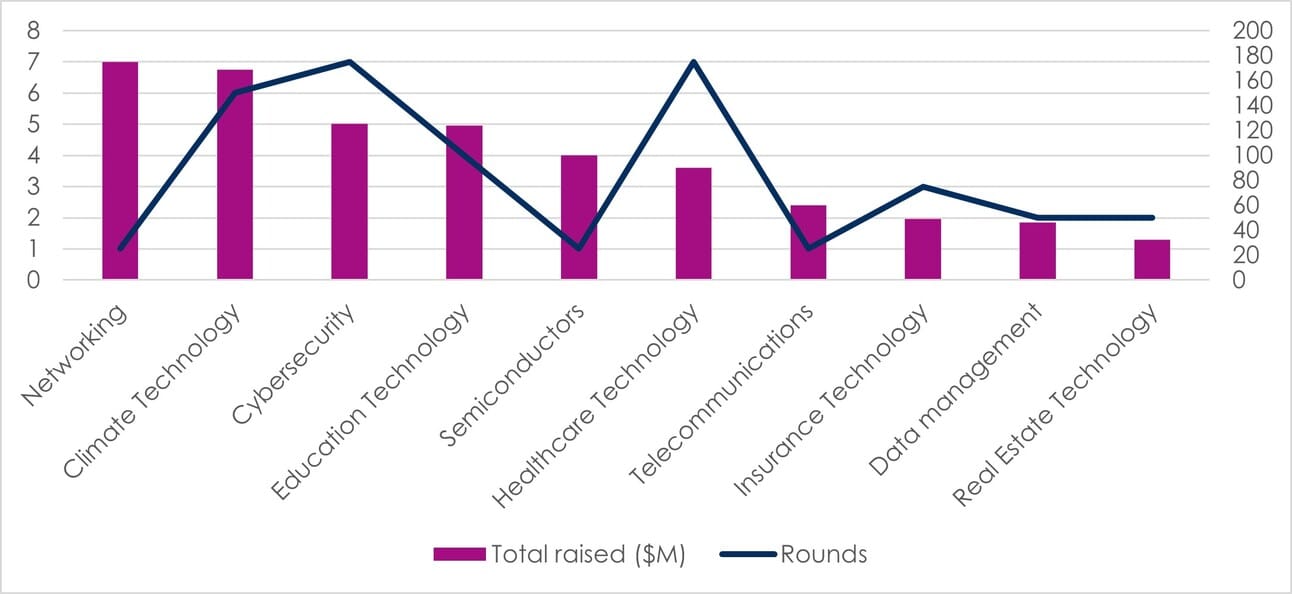

Figure 1. Top funded sectors between July 31 and August 4, 2023.

Source: TF Analytics.

Networking technology attracted most capital this week, owing to just one large deal. Nile, a networking equipment manufacturer raised $175 million (More on Nile in the funding round dive) from lead investor March Capital, a $1.6 billion AUM venture fund.

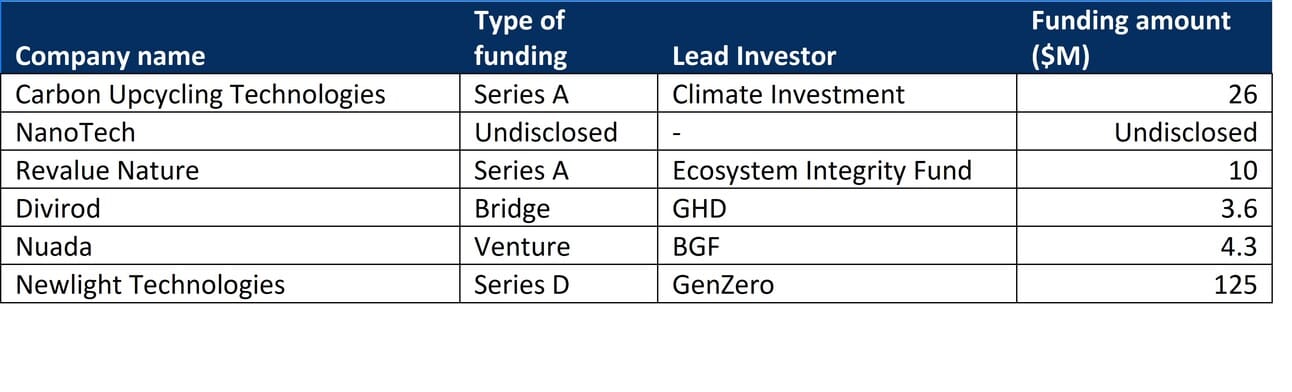

Climate technology is second and has been one of the top drawers of capital in recent weeks and months. Six startups raised a total of $168 million last week. Carbon capture technology is seeing a lot of inflows, with raises by Newlight Technologies ($125 million), Revalue Nature ($10 million), and Carbon Upcycling Technologies ($26 million).

Source: TF Analytics.

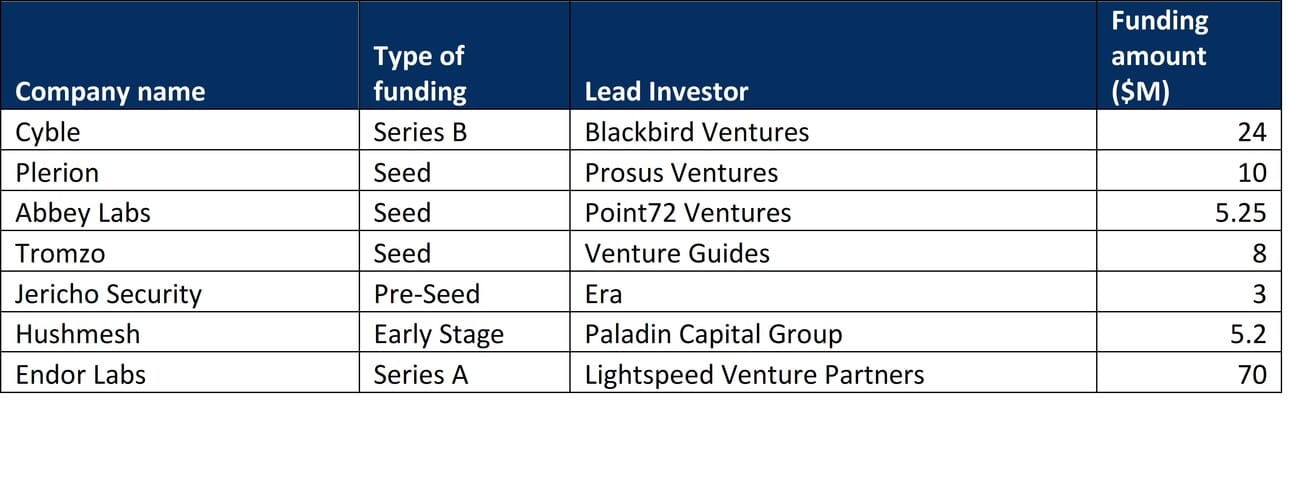

Cybersecurity has again been one of the best attractors of capital (Readers can read a sector deep dive in newsletter #2). Cybersecurity faces massive macro tailwinds like rising geopolitical tensions, increasing cost of breaches, and remote work resulting in distributed workforces, as well as sector-specific drivers like shortage of security specialists, growing privacy requirements and the rising popularity of DevSecOps. The companies that were funded this week run the gamut from app security (Endor Labs and Tromzo), threat intelligence (Cyble) and phishing (Jericho Security).

Source: TF Analytics.

Funding round: Nile

Nile, founded by former Cisco Systems executives John Chambers and Pankaj Patel, aims to challenge their former employer. This would not be the first successful Cisco challenger. Andy Bechtolsheim, a serial entrepreneur and former Cisco executive, founded Arista Networks about two decades ago. Arista now has a $55 billion market capitalization, with the stock tripling in the past three years. Nile has adopted the so-called network-as-a-service (NaaS) model, which it claims can reduce costs for customers by half compared with other alternatives thanks to lack of upfront equipment costs. According to Gartner, Nile has better reviews from customers than Cisco.

Sector: Semiconductors

The decades-old semiconductor industry is seeing a startup revival thanks to tailwinds like artificial intelligence, government support in Europe and the U.S., as well as a realization in the Western world that semiconductors are key to national interest.

In this stock market rally, top performers are semiconductors. Ten of the 20 top tech outperformers between S&P 500’s previous high reached in late 2021 and now are semiconductor companies. Nvidia Holdings, On Semiconductor and Photronics are among them.

Sure, it would be wrong to put all semiconductor companies in the same basket. Semiconductors for PC and smartphones have reached maturation and are stagnating, and the overall semiconductor revenue is expected to decline 11% in 2023 to nearly $532 billion, according to Gartner. However, emerging applications in the automotive industry, aerospace, and machine learning drives demand for specialized and high-end semiconductors.

In startup funding, semiconductors are not getting funded often, but they do usually get large rounds. Just this week, Tenstorrent, which aims to make semiconductors for artificial intelligence applications, nabbed $100 million from Hyundai Motor Group and Samsung.

Here is a list of semiconductor companies that were funded recently:

Source: TF Analytics.

That’s it.