- Tech Funding Daily

- Posts

- Tech funding weekly

Tech funding weekly

Healthcare tech, cybersecurity, artificial intelligence.

Welcome to our #4 weekly newsletter on funding in the technology sector.

This newsletter is designed for the busy investors in the tech startup scene, including venture capitalists, private equity professionals, and hedge funds, as well as investment bankers and startup founders. Plus, everyone else that wants to keep abreast of what is happening in the buoyant tech funding scene.

Our aim is not only to provide a newsletter on tech funding, but also granular data that our subscribers can use in their line of work. This includes a comprehensive list with company names, investors, type of fundings, sectors, and business descriptions, among others. For more information, please contact us at [email protected].

TF AnalytiX team.

Sector analysis:

For the past week, we counted 78 funding rounds in the tech sector for a total amount raised of about $1.5 billion, comfortably beating last week’s run even though August is typically a slow month. Before we dive in, we’d note a sizable fintech deal that occurred in Hong Kong and has been excluded from this analysis because it is outside Europe and North America. MicroConnect, a lending startup, raised $458 million from Baillie Gifford and Sequoia China at a valuation of $1.7 billion.

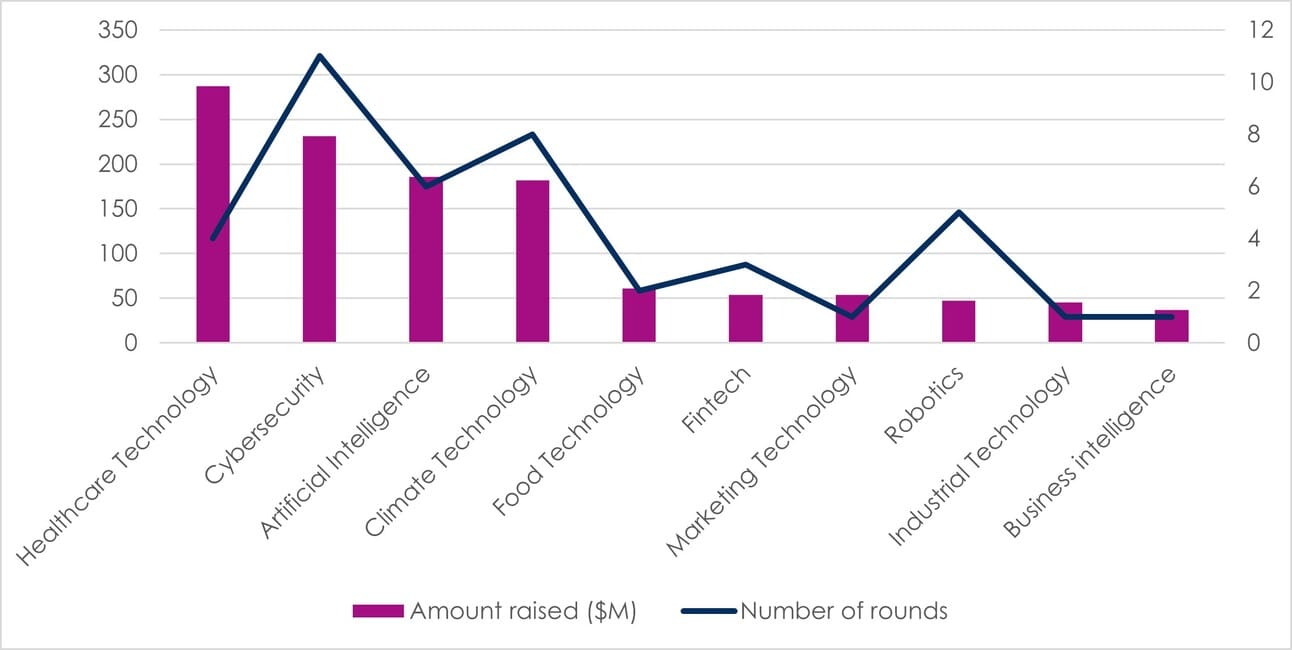

Figure 1. Top funded sectors between August 7 and August 13.

Source: TF AnalytiX.

Healthcare tech raised most money by far, largely thanks to the $280 funding round secured by Neuralink, Elon Musk’s brain computer interface implants startup. Clinetic, which aims to accelerate research by using electronic health records, raised an undisclosed amount in a Series A led by Sopris Capital. In the other two rounds, KetoSwiss, a startup developing brain supplements, secured $4.8 million in a Series A from The William K. Warren Foundation, while Basys.ai, a health systems automation SaaS provider, raised $2.4 million from Nina Capital and Lilly Ventures, among other venture capital funds.

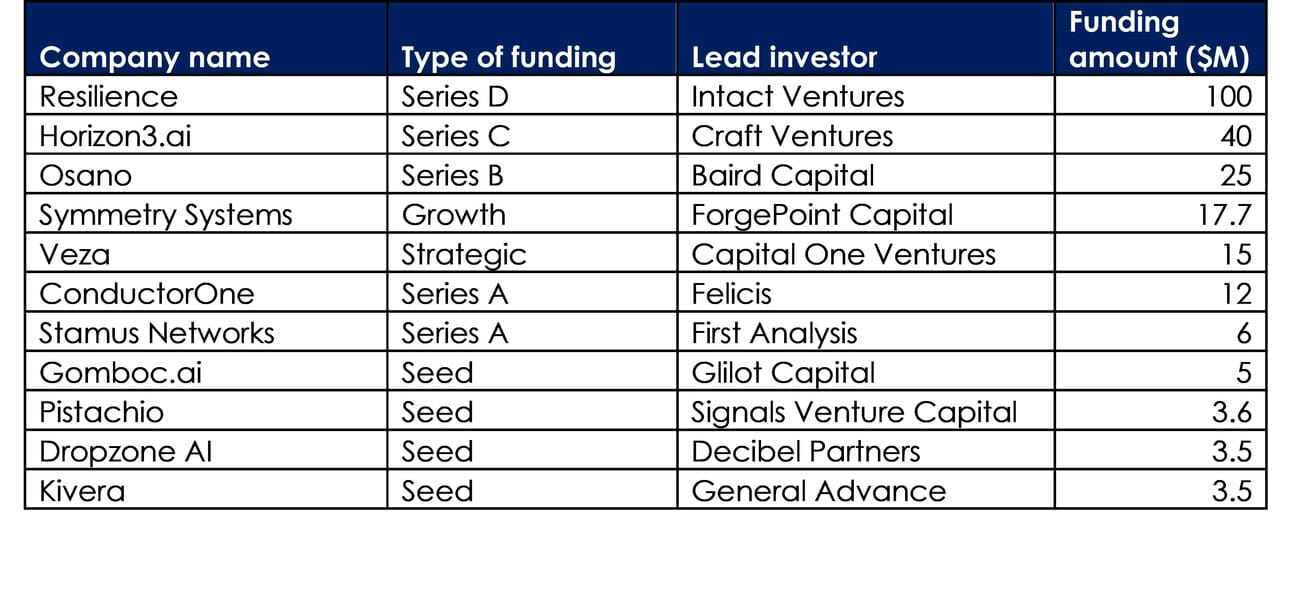

Cybersecurity is the second most-funded sector this week and saw the most funding rounds (readers can read a sector deep dive in newsletter #2). Preparation against potential attacks is the best security and organizations are increasingly looking at solutions that help identify vulnerabilities, test systems, and provide cybersecurity training. Resilience provides a platform that helps companies measure their cybersecurity risk, Horizon3.ai and Symmetry Systems help organizations continuously assess their security posture, and Pistachio sells cybersecurity training and attack simulation solutions.

Figure 2. List of cybersecurity startups that were funded between August 7 and August 13.

Source: TF AnalytiX.

Artificial intelligence

It is difficult to pin down artificial intelligence companies these days. A vast majority of startups use words like AI-driven, AI-based, or something of the sort to describe themselves. But most of them are not AI, as we would define them. In our view, an AI company develops generative AI models by using machine learning, or uses a third-party AI model for a niche use case, like video, or code as its primary business (a CRM that adds an AI chatbot to its offering is not an AI company, it’s a CRM).

AI will become ubiquitous and will most likely encompass the entire tech sector, like software did. Describing a company as doing software in a tech context is saying nothing these days. Everyone does software. It made sense in the 90s, when most tech was still hardware driven. Now, there is potential that AI will become the tech sector.

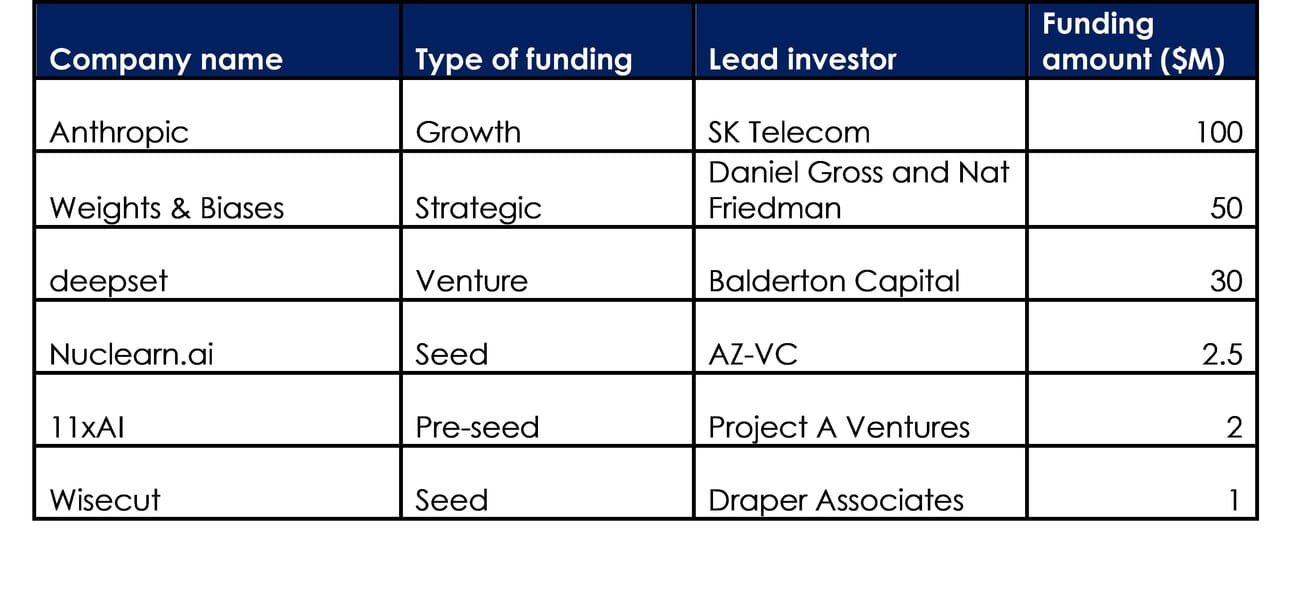

This week, Anthropic, the creator of Claude AI chatbot, raised $100 million from Korea-based SK Telekom. The investment is strategic, as SK Telecom will partner with Anthropic to develop a multilingual large language model that supports languages like Korean, Japanese and German. Weights & Biases raised $50 million from Daniel Gross and Nat Friedman. The company provides tools helping developers build ML models, with clients including Microsoft, Meta Platforms and MosaicML.

Figure 3. List of AI startups that were funded between August 7 and August 13.

Source: TF AnalytiX.

Type of funding analysis:

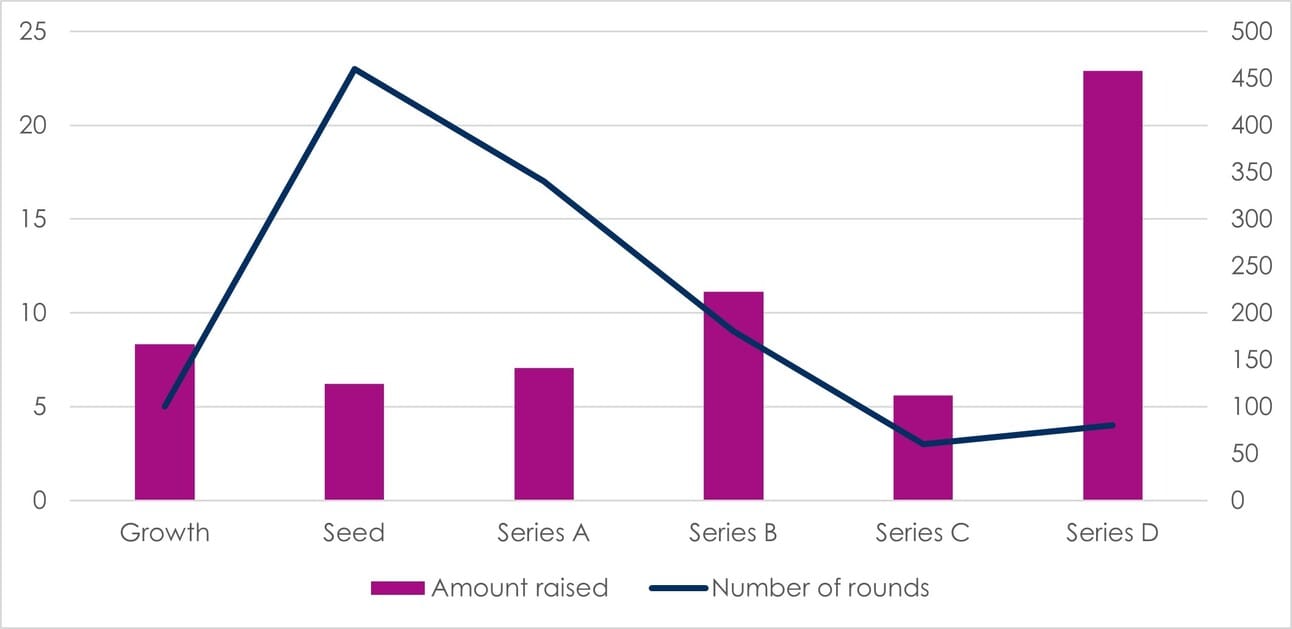

Around 40 startups raised a total of $270 million in Seed and Series A funding rounds. The checks are relatively small in these categories and have been going down in value in the past year. More funds are being invested in mature companies, which have proven business models. Resilience, Neuralink, Boston Micro Fabric and Simon Data, collectively raised more than the 40 Seed and Series A startups.

Figure 4. Type of funding.

Source: TF AnalytiX.

Here’s what we enjiyed reading this week: