- Tech Funding Daily

- Posts

- Tech funding last week

Tech funding last week

Cybersecurity sector dive, Croissant launch, funding update.

Welcome to our weekly newsletter on funding in the technology sector.

This newsletter is designed for the busy investors in the tech startup scene, including venture capitalists, private equity professionals, and hedge funds, as well as investment bankers and startup founders. Plus, everyone else that wants to keep abreast of what is happening in the buoyant tech funding scene.

We do not want to provide just a newsletter on funding, but also granular data that our subscribers can use in their line of work. This includes a comprehensive list of funded company names, investors, type of fundings, sectors, and business descriptions, among others. Please contact us for more information.

Kind Regards,

TF Analytics

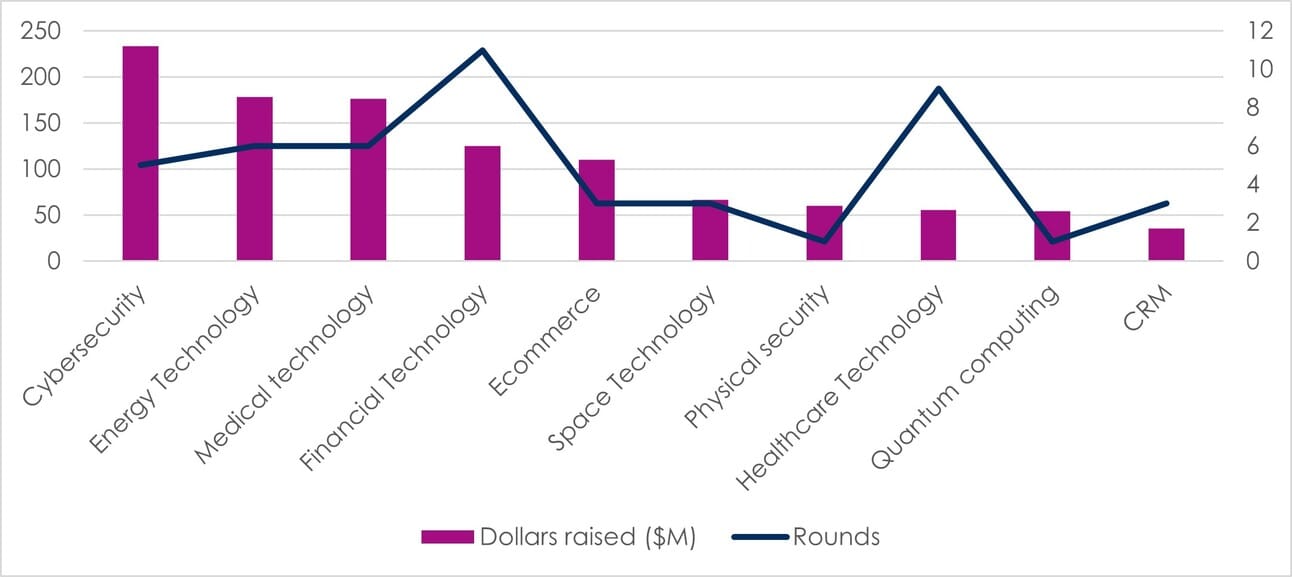

For the past week, we counted 81 funding rounds in the tech sector, with around $1.3 billion raised. The cybersecurity sector raised the most money across five rounds. OneTrust’s $150 million raise was the largest in the past week, followed by ecommerce software provider AppHub ($90 million) and medical imaging company RapidAI.

Fintech was fourth by total money raised, but it scored most funding rounds. Bunq, a Netherlands-based challenger bank, raised nearly $50 million to expand into the U.S., followed by Croissant, which emerged from stealth with $24 million in funding from Portage and KKR founders George Roberts and Henry Kravis.

Figure 1. Top funded sectors between 23 July 2023 and 29 July 2023.

Source: TF Analytics.

Funding round: Croissant

Croissant aims to establish a new market niche by providing luxury fashion customers with a guaranteed buyback value at checkout. This puts it in competition with well-known second-hand fashion marketplaces like Vestiaire Collective, Poshmark, and the RealReal. Notably, Croissant handles the resale process, removing the need for merchant or buyer involvement. The business model appears to blend elements of buy-now-pay-later (BNPL) and fashion re-sale. As both BNPL and fashion re-sale have been grappling with profitability challenges, it remains uncertain how Croissant can avoid similar issues. But even if the company isn't profitable, rapid growth, which does not seem hard to achieve, could lead to a valuation of $1 billion or $2 billion before a potential acquisition. For instance, Poshmark, had negative Ebitda margins of 9% when it was acquired by Naver for $1.2 billion late last year.

Sector: Cybersecurity

Image by Freepik

The cybersecurity sector has been one of the top draw for venture capitalists in recent years. Unsurprisingly, security is one of the last areas to face budgets cuts from organizations in a challenging macroeconomic environment, as the fear of monetary and reputational damage from an incident well outweighs the costs.

Cybersecurity has macro and sector-specific tailwinds that will persist in the near future. Here are some of the macro drivers we have identified:

1. The number of cybersecurity incidents and their cost is rising, according to this report from IBM.

2. Growing geopolitical tensions, with the U.S. and China trade war, and Russia-Ukraine war, leads to more complex and frequent attacks.

3. Remote work results in a more distributed workforce, which increases vulnerability.

Sector specific drivers:

1. Security specialists are in short supply, which leads many organizations to outsource part or all of their cybersecurity needs to managed service providers or rely more on security automation platforms. According to Gartner, 60% of organizations will use remote threat disruption capabilities delivered by managed detection and response providers by 2025, compared with 30% now. NetCraft, a security automation and posture management platform, raised $100 million from Spectrum Equity recently.

2. Growing privacy requirements from consumers and governments increases demand for providers of privacy and data governance solutions. PrivacyHawk, a personal data protection provider, raised $2.7 million recently. The aforementioned OneTrust also falls into this category.

3. The growing popularity of DevSecOps approach to security results in growing demand for application security software. DevSecOps, as opposed to the traditional DevOps, results in a more robust security framework because itis tested in the development process in contrast to being added in the aftermath. Recent raises in the application security sector were closed by Secure Code Warrior, Adaptive Shield and SAVVY.

4. The emergence of artificial intelligence boosts demand for security tailored to AI and machine learning applications, as well as data security. Consider recent raises by Protect AI and Teleskope.

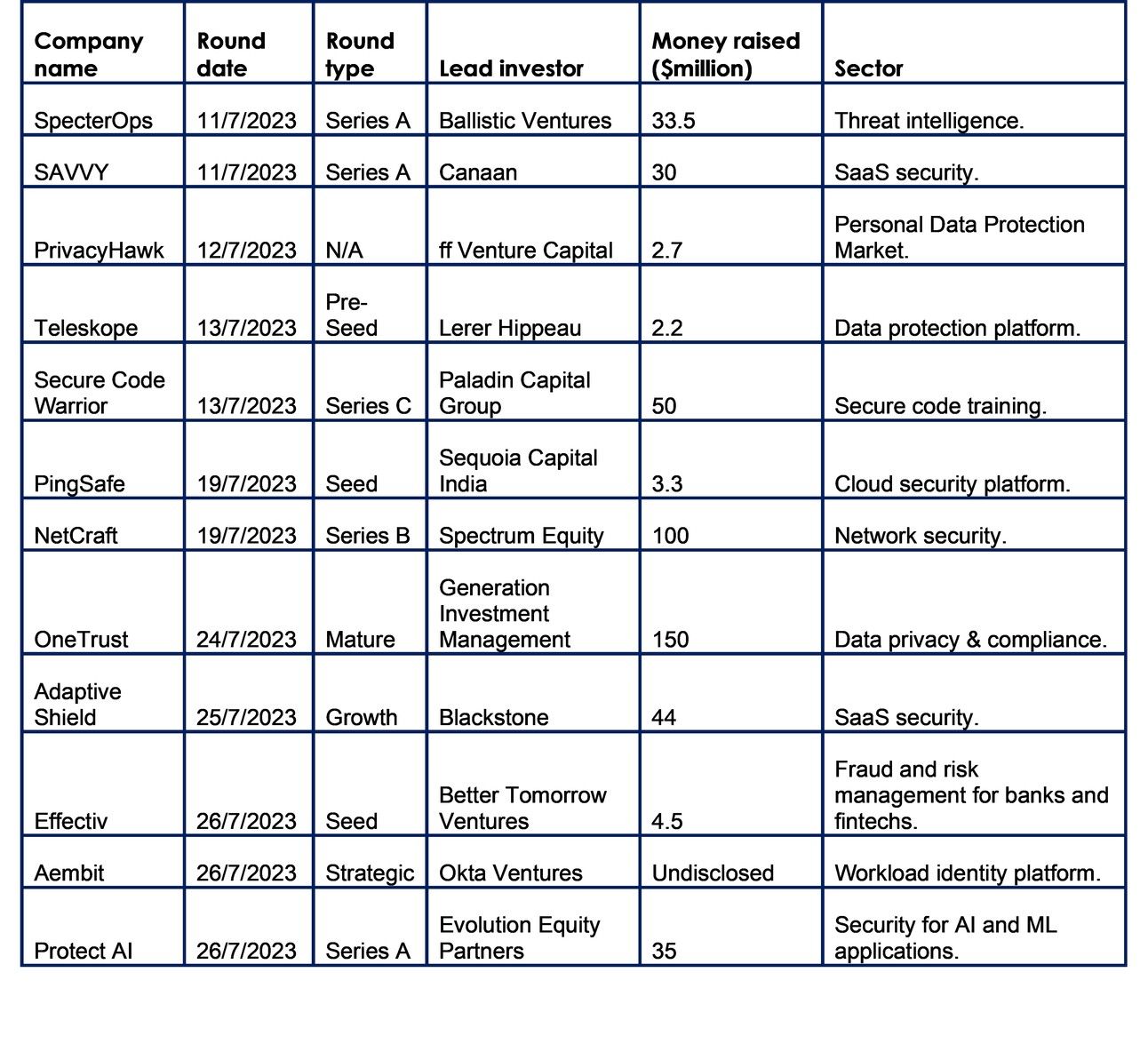

Here is a list of recent funding rounds in cybersecurity:

Source: TF Analytics.

For startups, one of the biggest advantages that cybersecurity has over many other industries is the relative ease of exit via M&A. In addition to financial sponsors like Thoma Bravo and cybersecurity strategics, there is buoyant and increasing demand from non-cybersecurity strategics. Large enterprise players like Microsoft, Cisco, Amazon and Alphabet are keen to add cybersecurity features to their current offerings, be it cloud, network or communications. As examples, Cisco made a host of security acquisitions this year already, and Alphabet last year acquired Mandiant for $5.4 billion.